Forex trading, or foreign exchange trading, offers beginners a dynamic and potentially lucrative opportunity to participate in the world’s largest and most liquid financial market. However, navigating the complexities of the forex market requires a solid understanding of fundamental principles, risk management techniques, and effective trading strategies. Let’s explore some essential forex trading strategies tailored for beginners to help them embark on their trading journey with confidence and competence.

- Understanding Market Fundamentals:

Before diving into forex trading, beginners must grasp the fundamental concepts that drive currency markets. Familiarize yourself with key economic indicators, central bank policies, geopolitical events, and market sentiment factors that influence currency prices. Stay informed about major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, and their respective drivers to make informed trading decisions.

- Developing a Trading Plan:

A well-defined trading plan is essential for success in forex trading. Define your trading goals, risk tolerance, and time horizon before executing any trades. Determine your preferred trading style, whether it’s day trading, swing trading, or position trading, and develop a systematic approach to identify entry and exit points based on technical analysis, fundamental analysis, or a combination of both.

- Mastering Technical Analysis:

Technical analysis is a cornerstone of forex trading, providing traders with valuable insights into price movements and trends based on historical price data. Learn how to analyze charts, identify key support and resistance levels, and use technical indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands to make informed trading decisions.

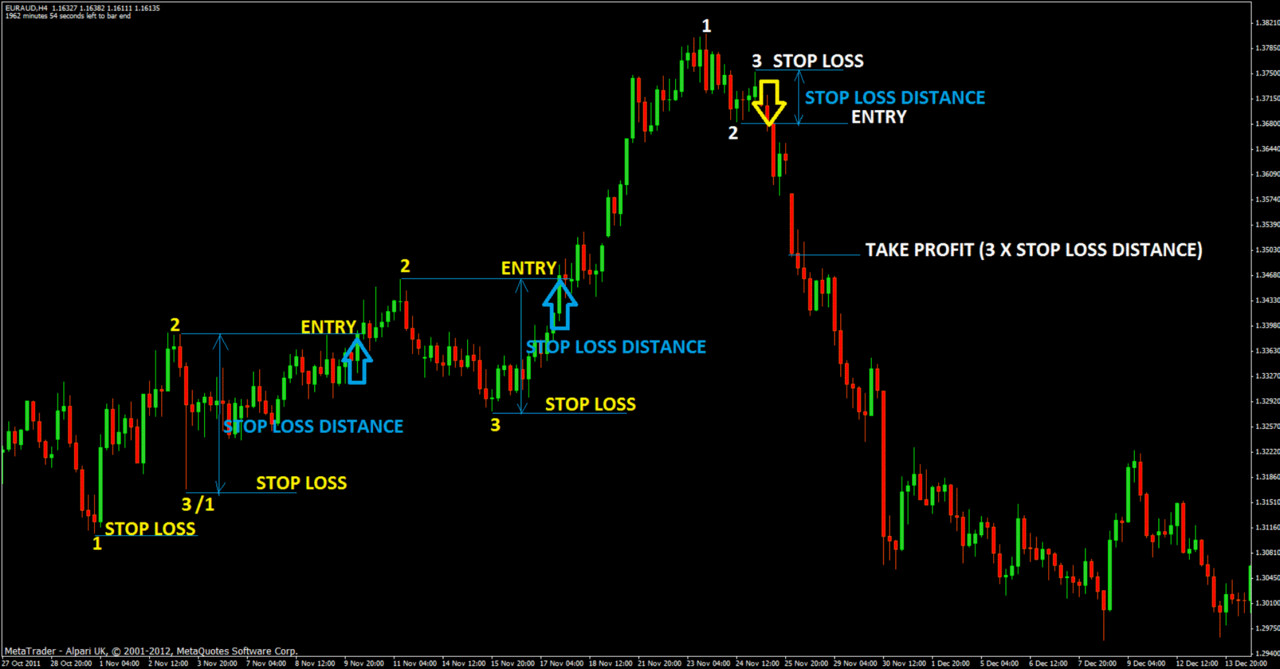

- Implementing Risk Management Strategies:

Risk management is paramount in forex trading to protect your capital and preserve trading longevity. Never risk more than a small percentage of your trading capital on any single trade, and use stop-loss orders to limit potential losses. Set realistic profit targets and maintain a favorable risk-reward ratio of at least 1:2 to ensure that potential profits outweigh potential losses over time.

- Starting with Demo Trading:

Practice makes perfect in forex trading, and beginners should start by honing their skills and testing their strategies in a risk-free environment. Open a demo trading account with a reputable forex broker and practice executing trades, managing risk, and refining your trading strategy without risking real money. Use demo trading to gain experience, build confidence, and develop discipline before transitioning to live trading.

- Continuing Education and Adaptation:

Forex trading is a lifelong learning journey, and successful traders continually seek to expand their knowledge and skills. Stay updated on market developments, attend webinars, read books and articles, and participate in online forums and trading communities to learn from experienced traders and stay ahead of the curve. Adapt your trading strategy to evolving market conditions, refine your approach based on feedback and experience, and remain flexible and open-minded in your trading approach.

- Patience and Discipline:

Forex trading requires patience, discipline, and emotional control to navigate the inherent uncertainties and fluctuations of the market. Avoid chasing short-term profits or succumbing to impulsive trading decisions based on fear or greed. Stick to your trading plan, maintain a consistent trading routine, and accept that losses are an inevitable part of trading. Stay focused on the long-term goal of becoming a successful and profitable trader, and don’t let temporary setbacks derail your progress.

In conclusion, forex trading offers beginners an exciting opportunity to participate in the global currency markets and potentially achieve financial independence. By understanding market fundamentals, developing a trading plan, mastering technical analysis, implementing risk management strategies, practicing with demo trading, continuing education, and cultivating patience and discipline, beginners can embark on their forex trading journey with confidence and competence. Remember, forex trading is not a get-rich-quick scheme, but rather a disciplined and systematic approach to wealth creation that requires dedication, perseverance, and ongoing learning.