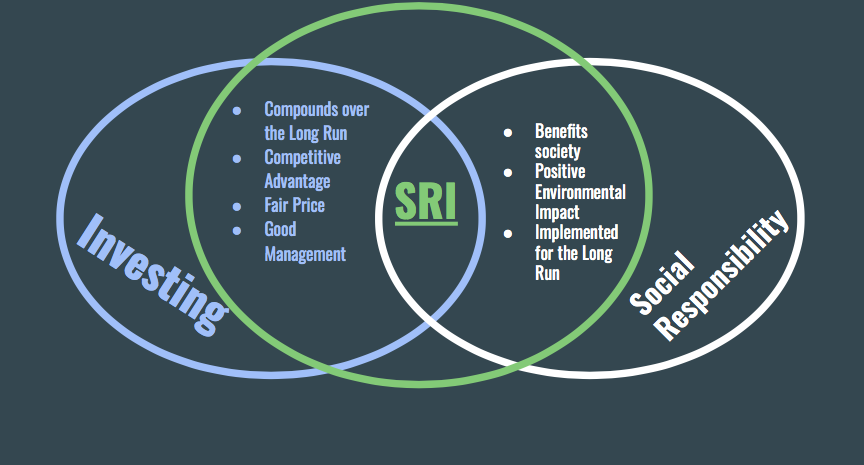

In recent years, a growing number of investors have embraced socially responsible investing (SRI) as a means to align their financial goals with their ethical values. SRI, also known as sustainable, responsible, or impact investing, involves considering environmental, social, and governance (ESG) factors alongside financial returns when making investment decisions. However, the debate persists: can investors achieve both profit and purpose through SRI, or is there an inherent trade-off between the two? Let’s explore the complexities of socially responsible investing and the ongoing pursuit of balancing profit and purpose.

- Defining Socially Responsible Investing:

Socially responsible investing encompasses a range of approaches aimed at integrating ESG considerations into investment decisions. This may involve screening out companies involved in controversial industries such as tobacco, firearms, or fossil fuels, as well as actively selecting companies with strong ESG performance or promoting positive social and environmental outcomes through shareholder engagement and impact investing.

- Profitability vs. Impact:

One of the central questions in socially responsible investing is whether investors can achieve competitive financial returns while also making a positive impact on society and the environment. Skeptics argue that prioritizing ESG criteria may limit investment opportunities and lead to lower returns compared to traditional investment strategies focused solely on financial metrics. However, proponents of SRI point to growing evidence suggesting that companies with strong ESG performance may outperform their peers over the long term, driven by factors such as risk mitigation, brand reputation, innovation, and stakeholder trust.

- Risk Management and Long-Term Sustainability:

Socially responsible investing is increasingly recognized as a means of managing investment risks and enhancing long-term sustainability. By considering ESG factors, investors can identify companies with robust governance structures, ethical business practices, and proactive risk management strategies, reducing the likelihood of negative events such as regulatory fines, lawsuits, or reputational damage. Moreover, companies that prioritize sustainability may be better positioned to capitalize on emerging opportunities in sectors such as renewable energy, clean technology, and healthcare innovation, driving innovation and value creation over time.

- Stakeholder Engagement and Influence:

Another key aspect of socially responsible investing is shareholder engagement, whereby investors actively participate in corporate governance processes and advocate for positive change within companies. By engaging with management teams and exercising their voting rights, investors can encourage companies to adopt more sustainable practices, improve transparency, and address social and environmental challenges. This form of constructive engagement enables investors to align their financial interests with their values and contribute to positive social and environmental outcomes while generating competitive returns.

- Measuring Impact and Transparency:

As interest in socially responsible investing grows, there is a growing emphasis on measuring and reporting the impact of investments on ESG outcomes. Investors are increasingly demanding greater transparency and accountability from companies regarding their ESG performance, disclosure practices, and alignment with internationally recognized standards such as the United Nations Sustainable Development Goals (SDGs) and the Task Force on Climate-related Financial Disclosures (TCFD). By quantifying and reporting on the social and environmental impact of investments, investors can assess their contribution to broader sustainability goals and hold companies accountable for their actions.

- Navigating Trade-Offs and Complexity:

Despite the potential benefits of socially responsible investing, navigating the trade-offs and complexities inherent in balancing profit and purpose remains a challenge for investors. Ethical considerations, regulatory requirements, evolving market dynamics, and diverse stakeholder interests can introduce layers of complexity and uncertainty into the investment decision-making process. Moreover, the definition of what constitutes socially responsible investing may vary widely among investors, making it essential for investors to clarify their values, priorities, and objectives when designing their investment strategies.

In conclusion, socially responsible investing represents a powerful means of aligning financial goals with ethical values and promoting positive social and environmental outcomes. While the pursuit of profit and purpose may entail trade-offs and complexities, evidence suggests that integrating ESG considerations into investment decisions can enhance risk-adjusted returns, drive long-term sustainability, and contribute to positive societal impact. By embracing socially responsible investing, investors have the opportunity to harness the power of capital markets to create a more sustainable and equitable world for future generations.